The fashion industry is dizzyingly brutal. Just this past May, Swiss luxury brand Bally announced it was parting ways with Rhuigi Villaseñor—the founder and designer of Los Angeles-based brand Rhude. Villaseñor assumed the role of Bally’s creative director in January 2022 and only managed to showcase two collections before getting the boot.

But that’s not even the shortest creative director stint in the past year thus far.

French designer Ludovic de Saint Sernin made his creative directorial debut with a runway collection for Ann Demeulemeester during Paris Fashion Week’s Autumn/Winter 2023 show season. The gender-fluid and skin-baring collection garnered quite a buzzy reception and reportedly prompted stockists the likes of MyTheresa to renew their relationship with the brand. Alas, even before the collection could be realised for retail, Ann Demeulemeester ended de Saint Sernin’s time—a mere two months after his debut runway show.

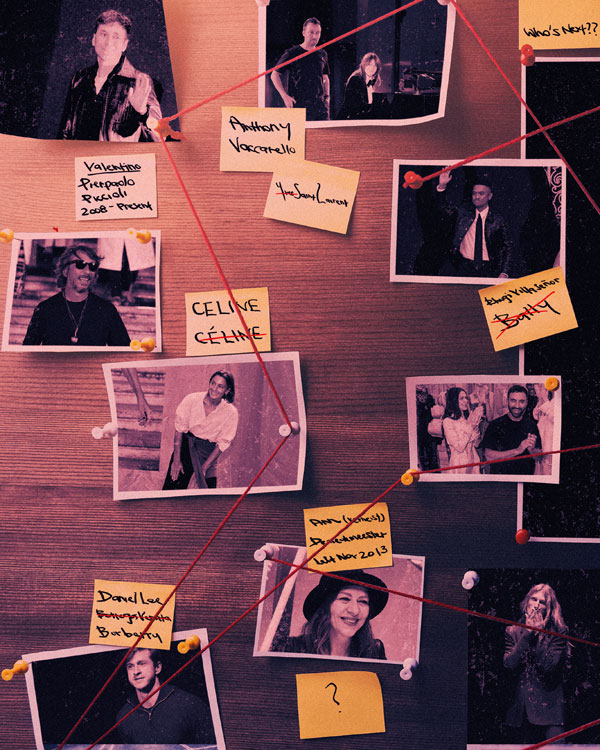

It is hardly a new phenomenon. The fashion industry has been going through creative directors so quickly and frequently that having one lasting longer than the regular contractual three years can be considered a unicorn. We have seen numerous occasions where creatives have been cycled through as though they were in a game of musical chairs: Anthony Vaccarello replacing Hedi Slimane at Saint Laurent making way for the latter’s entry to Celine after Phoebe Philo; Kim Jones departing Louis Vuitton to join Dior Men while its former creative director Kris Van Assche went on to head Berluti; and Riccardo Tisci’s jump from Givenchy to Burberry, only to be replaced by Daniel Lee from Bottega Veneta.

Trust us, to say that all this gets confusing for fashion journalists too, is an understatement.

Change is constant and especially so in fashion. While defining a clear, signature aesthetic is undoubtedly the goal for any brand, big or small, there’s often a delicate balance that creative directors have to strike—crafting a distinguishable look while ensuring a consistent flow of excitement that hopefully translates to increased profits. Lest we forget, fashion is a business. And as much as the industry thrives on new, buzzy ideas, consumer dollars are king and these ideas have to resonate with a buying audience at the end of the day.

Zegna’s Alessandro Sartori—already into his seventh year as artistic director—has proven to be a master at evolving a defined aesthetic. Part of the family-run Zegna Group, Zegna is founded on menswear tailoring backed by the company’s expertise in luxurious fabrics. Sartori’s evolution of the brand’s aesthetic appears to be a shrewd calculation of slow and steady. His debut Spring/Summer 2017 collection kicked things off with a unification of Zegna’s then-different lines while still retaining elements of its core tailoring business. Suiting was matched with inflections of sporty dress that introduced a more relaxed approach to Zegna’s tailoring.

Season after season, the silhouette gradually shifted. Trousers got roomier and outerwear grew to be cut oversized with drop shoulders almost a given on every design. It was after the Covid-19 pandemic that the evolution seemed to have accelerated. Sartori referred to the Autumn/Winter 2021 collection as a representation of being in “a world where the indoor and the outdoor are colliding”, resulting in a softening of traditional tailoring lines and construction, making way for elegant ease that has since remained.

While the sportier Z Zegna offshoot is no longer in production, Zegna has offered collaborations with brands specialising in certain areas of sports. Its latest this past January was one with trail-running shoe brand norda as part of Zegna’s growing Outdoor collection.

Coupled with a thorough rebranding exercise—the brand dropped the first name of its founder and has been going by Zegna as of December 2021, complete with a new logo and coloured signifier—the strategy has paid off. For the first quarter of 2023, Zegna’s reported revenue grew 21.4 per cent year-over-year to EUR271.9 million.

Gucci took a different approach. Its appointment of the relatively unknown Alessandro Michele in 2015 created a seismic shift in an industry where the tried and tested are often favoured. Michele’s clear vision of a more poetic and referential Gucci, marked by an exuberantly excessive styling, was a stark departure from his predecessor’s. It was the dawn of a new era, one that was quickly lapped up by both insiders and consumers alike. Gucci saw a boom like never before, landing at the top of every luxury fashion list imaginable, alongside being Kering Group’s top-performing asset.

Michele’s meteoric ascension and cultural-shifting aesthetic, however, proved to be his downfall. The look that he crafted became so distinct that it eventually fell victim to consumer fatigue. Although Gucci remained Kering Group’s majority revenue earner—it accounted for 52 per cent of the group’s total revenues in 2022—its growth started lagging behind other Kering-owned fashion houses such as Saint Laurent and Bottega Veneta.

To his credit, Michele did inject excitement throughout his tenure. Collaborations were plentiful, ranging from a capsule collection with one of South Korea’s top entertainers Kai, to an unprecedented two-pronged partnership with Balenciaga. But at the same time, these contributed to an onslaught of the GG monogram that was central to Michele’s design vocabulary—almost every collection incorporated the motif in some form and it became overwhelming and predictable. To the consumer, it was too much of the same thing.

There’s often so much emphasis on the creative director that the essence of the brand that hired them gets lost. Hiring established figures can thus be a double-edged sword. In the hopes of tapping into their prior commercial successes, brands have handed over their design reins to big name creative directors. But every brand is different, and well-known creatives come packaged with their own signature look, which can be boon or bane. Much like forcing a square peg into a round hole, attempting to adapt and weave a creative’s aesthetic into a brand is hardly a surefire hit.

Burberry lost traces of its Britishness when Riccardo Tisci took over as the brand’s chief creative officer. His goth streetwear leanings—a winning combination throughout a 12-year appointment at Givenchy—were pared back to be remixed into Burberry’s more sartorial heritage. There were the odd spikes and embellishments peppered here and there, animal motifs (another Givenchy-era design trope) and heavy-handed use of streetwear elements that all felt forced. The aim seemed to be to create a new Givenchy, even if the world had already moved on from that particular style.

That’s not to say that having an individual point of view spells disaster. Hedi Slimane’s time at a wholly rebranded Celine mirrors more of his personal style than that of the clean, minimalist leanings built by former creative director Phoebe Philo. A hardcore fanbase and the sheer consistency of his vision helped Celine achieve a revenue exceeding EUR2 billion for 2022—all despite the initial blowback from Philo devotees.

There’s no clear-cut solution because no two fashion brands are exactly alike. Each possesses its own unique set of challenges that require different approaches to strengthen its identity. And it gets compounded if a designer’s stamp has become so intertwined with a brand that they’ve inhabited.

A fashion brand/house should never be buoyed by a sole creative force. As harsh as it may sound, a creative’s time is finite. Ultimately, a brand’s strong, overall narrative has to stay consistent and somewhat untainted by an ever-changing roster of creatives. It’s one of the main reasons why some brands, more than others, continue to thrive despite relatively little creative changes at the top. Hermès, for example, repeatedly doubles down on its storied heritage of artisanship and playfulness with Véronique Nichanian at the helm of the men’s universe since 1988. At Loewe, Jonathan Anderson is still going strong after nine years of formulating a rich emphasis on art and craft. Similarly at Maison Margiela, where creative anonymity was taken over by John Galliano in 2014, the house’s avant-garde storytelling remains at its core.

Slimane-like radical changes are risky. And if done in repeated succession, especially within a short period of time, tend to dilute a brand’s identity. Or worse, confuses consumers. As much as fashion embraces newness and originality (if novelty is even a thing any more) a certain level of consistency is comforting. This is precisely why efforts like those employed by Sartori at Zegna as well as Vaccarello’s iteration of Saint Laurent are working. Both were strategically careful to transition and evolve slowly, thus allowing time for consumers—both existing and prospective—to adjust and follow along on their journeys.

And there’s the crux of it all: Time. It’s something that’s necessary, yet not every creative director is afforded it. A vision—and in relation, the strengthening of brand identity—requires time to be fully realised. Could Bally have expanded its brand narrative if Villaseñor were afforded time? Perhaps.

Gucci is gearing itself for another revival with the appointment of Sabato de Sarno. Like Michele, de Sarno is a relative unknown who had been working under Valentino’s Pierpaolo Piccioli. His debut for Gucci is scheduled for this September. Ann Demeulemeester also opted for a fresh perspective in the form of Stefano Gallici, a designer from within its own ranks.

Here’s hoping that they’re all given time. Or at the very least, are offered much needed creative inspiration in a new house.